does wyoming charge sales tax on labor

Wyoming charges a late fee that is equal to 10 of the total late sales tax as well as a 1000 late fee. 400 2022 Wyoming state sales tax Exact tax amount may vary for different items The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

State wide sales tax is 4.

. The wholesaler shall be entitled to retain four percent 4 of any tax collected under WS. If you do not file your sales tax return within 30 days of the due date of. In the state of Wyoming sales tax is legally required to be collected from all tangible physical products being sold to a consumer and certain services are taxed as well.

Those employers must pay employees all wages earned between the 16th and last day of any month on or before the 15th day of the following month. When this happens you are required to collect and remit sales tax in Wyoming because you created a sales tax Nexus. This page discusses various sales tax exemptions in Wyoming.

What does Wyoming charge sales tax on. In addition Local and. The Upcoming Law in Wyoming eCommerce sales tax rules in Wyoming are soon to take effect.

For example a television repair person must collect Sales Tax from the customer on the charges for both labor and the parts used for. Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific locations. Even if your business maintains its main headquarters in another.

It is also the same if you will use Amazon FBA there. Wyoming WY Sales Tax Rates by City A The state sales tax rate in Wyoming is 4000. Conduct educational seminars throughout the year.

No you do not pay sales tax on labor. Machinery raw materials utilities. Draft formal revenue rulings upon vendor and taxpayer request.

An employer in any of the above-listed. Sales and Use Tax. If I buy cigars from a company in Colorado who is not a.

Two different triggers will necessitate that businesses collect sales tax online. The state-wide sales tax in. You have to pay for these items in grocery food.

While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. With local taxes the total sales tax rate is between 4000 and 6000. As a business owner selling taxable goods or services you act as an agent of the.

Wyoming charges a late fee that is equal to 10 of the total late sales tax as well as a 1000 late fee. According to House Bill 169 raising the state sales and use tax rate from 4 to 5 could generate between 138 and 142 million for the state annually and approximately 63. Are services subject to sales tax in Wyoming.

In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs. This is the same whether you live in Wyoming or not. Although Wyoming charges 4 of sales tax a few items are exempt from the sales tax in Wyoming.

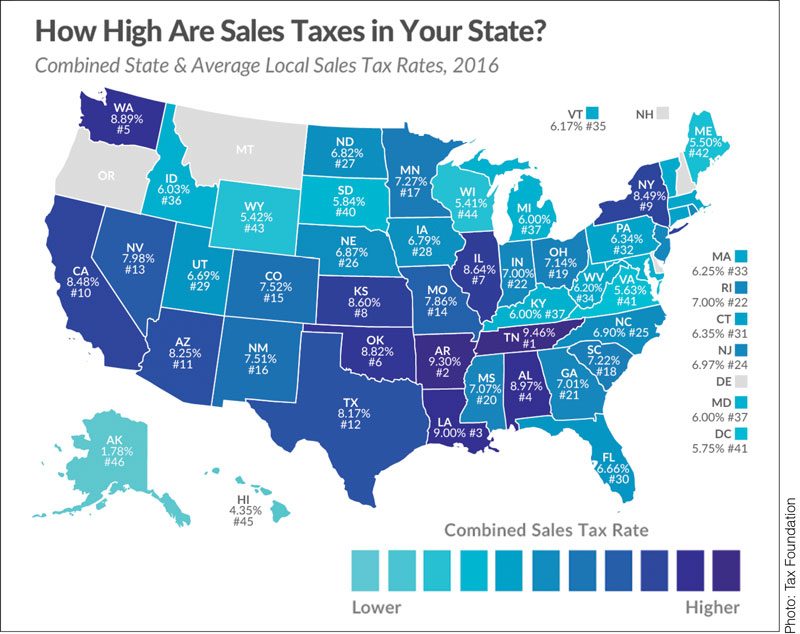

In Wyoming when a tool is lost down a hole or damaged beyond repair during the pre-production casing phase of an oil or gas well the charge for the tool will not be subject to. You can look up the local sales tax rate. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1472 for a total of.

The state of Wyoming does not usually collect sales taxes on the vast. Provide bulletins publications and other educational material to address commonly asked questions Did You Know. The state sales tax rate in Wyoming is 4.

11 - What is the 2022 Wyoming Sales Tax Rate. If a taxable good for which sales tax has been collected is returned or reposessed by the merchant the state may allow the amount of sales tax collected to be either deducted from the. TAXABLE In the state of Wyoming transportation by the use of an ambulance or hearse and certain transportation of freight or property raw farm products and drilling rigs are considered.

Groceries and prescription drugs are exempt from the. Currently combined sales tax rates in Wyoming range from 4 to 6 depending on the location of the sale.

Avoid Penalties By Staying Aware Of Sales Tax Laws

Sales Tax By State Is Saas Taxable Taxjar

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

.png)

States Sales Taxes On Software Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

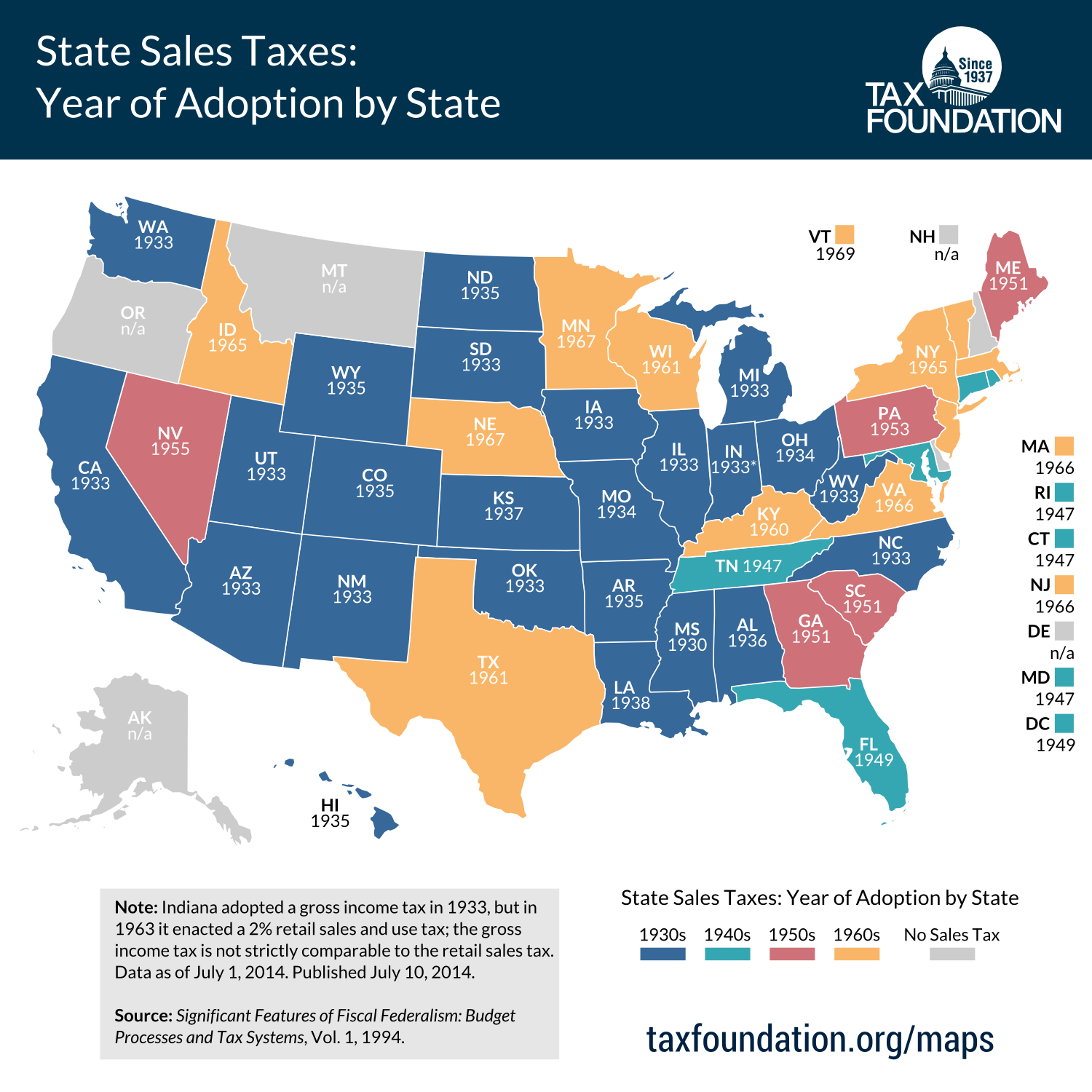

When Did Your State Adopt Its Sales Tax Tax Foundation

Monday Map State And Local Sales Tax Collections Tax Foundation

Ranking State And Local Sales Taxes Tax Foundation

Wyoming Sales Tax Handbook 2022

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Sales Tax Guide And Calculator 2022 Taxjar