ev charger tax credit 2021 california

A tax credit is also available for 50 percent of the equipment costs for the purchase and installation of alternative fuel infrastructure. The maximum credit is 1000 per residential.

How To Claim An Electric Vehicle Tax Credit Enel X

ADS-TEC HPC fast charging solution.

. Up to 1000 Back for Home Charging. Technically referred to as the Alternative. While the national EV charger tax credit ran out at the end of 2021 some utilities have introduced their own rebates and incentives.

The Modesto Irrigation District is offering a rebate of up to 500 on Level 2 electric vehicle charging stations for residential and commercial customers. See how much you could save getting behind the wheel of an EV whether you are buying or leasing. No grid expansion necessary minimal space required.

Just buy and install. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. Ad Homeowners and businesses who install an EV charger may qualify for rebates and incentives.

South California Edison SCE is offering. Technically referred to as the Alternative Fuel. The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs but it expired on December.

This incentive covers 30 of the cost with a maximum credit of up to 1000. Ad Ultra-fast charging for electric vehicles is now possible anywhere. After having expired at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back.

Utility-sponsored incentives change often as. For residential property 1000 is closer to an absolute cap because a taxpayer can have only one primary residence. Congress recently passed a retroactive federal tax credit for those who purchased.

Hey Californians so youve decided that you wanted to switch to an electric car. Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access. Congress recently passed a retroactive federal tax credit for.

EV Tax Credit Expansion. The second and larger bill sat within Bidens Build Back Better Act and subsequent increases to the federal tax credit but it couldnt get past the Senate in late 2021. See if you can receive a rebate for installing an EV charger in your home or business.

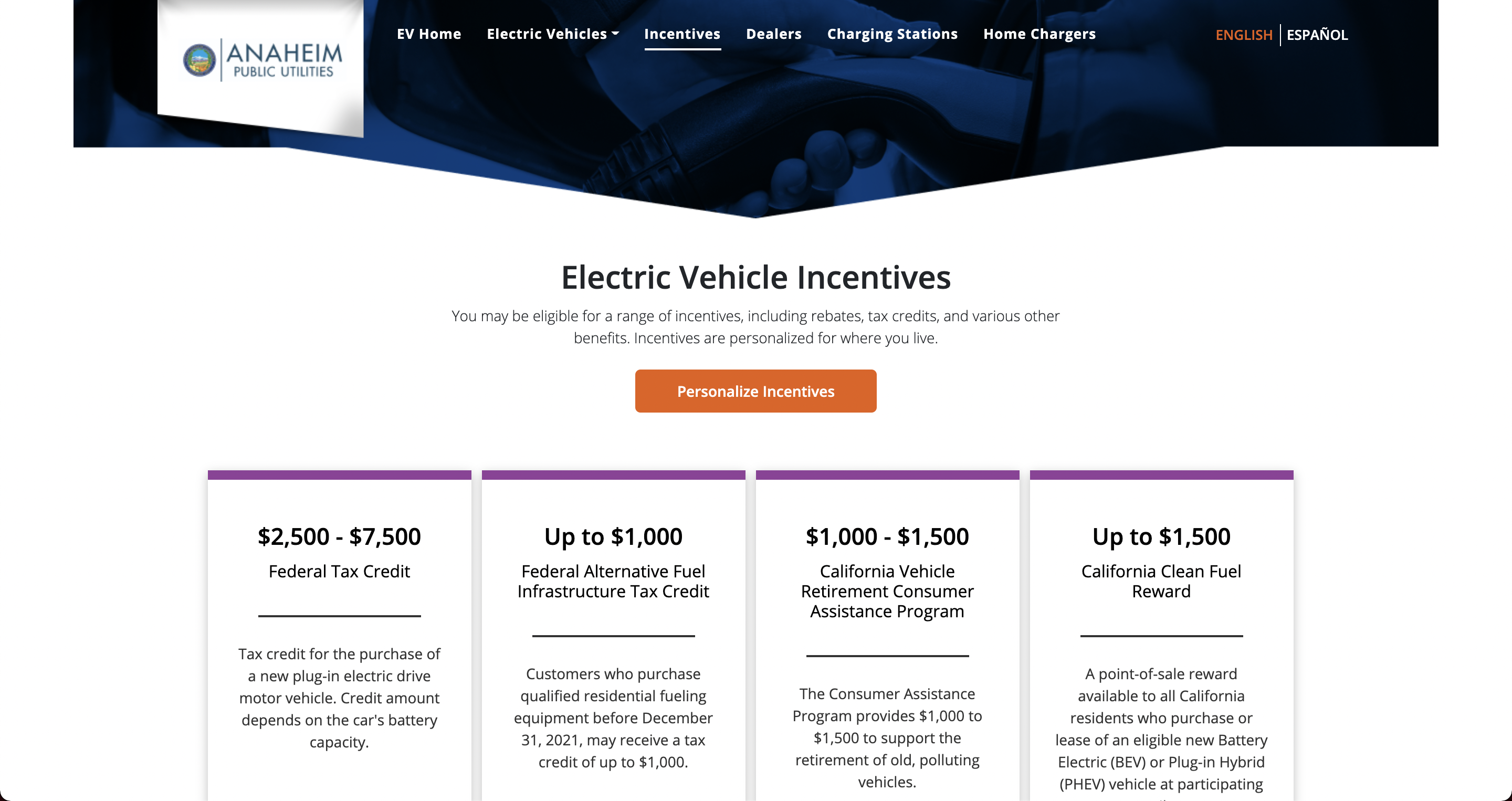

Explore potential EV incentives and tax credits. More incentives rewards rebates and EV tax credits are available to people who purchase or lease qualifying Battery Electric BEV or Plug-in Hybrid PHEV. However if a taxpayer relocated during 2021 and.

First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Or maybe you already own an electric car and youre. Purchase and install your ChargePoint EV Charging station by December 31 2021 and your business may be able to receive a 30 tax credit up to 30000.

Californias Electric Car Incentives 2021. Over 9000 in California EV rebates and EV tax credits available. A good rule of thumb for people thinking of purchasing an EV.

Central Coast Community Energy offers rebates on EV chargers purchased and installed between October 1 2021 and November 15 2022 Glendale Water and Power residential customers can. Californias Electric Car Incentives 2021. Ad Find and Compare the Best EV Chargers Based on Price Features Ratings Reviews.

This EV charger rebate program. See the IRS guidance. After expiring at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back.

Compare electric cars maximize EV incentives find the best EV rate. Residents who buy qualifying residential fueling equipmentincluding electric vehicle charging stationsbefore the end of the calendar year might be eligible for a tax credit. If so we have great news for you.

Theres an EV for Everyone. Every Month We Help Millions Find the Best EV Chargers More. 4500 for fuel cell electric vehicles FCEVs 2000 for battery electric vehicles 1000 for plug-in hybrid electric vehicles PHEVs.

Purchasing an EV Charging Station in 2021.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Rebates And Tax Credits For Electric Vehicle Charging Stations

Cec Report Finds California Needs 1 2m Public And Shared Ev Chargers By 2030 73k Installed To Date Green Car Congress

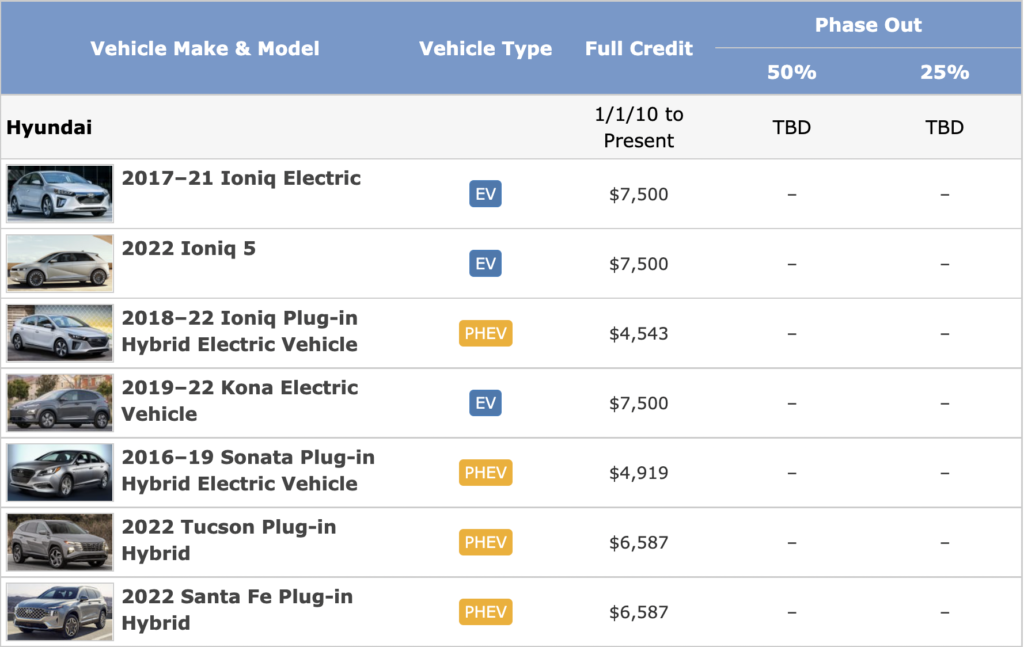

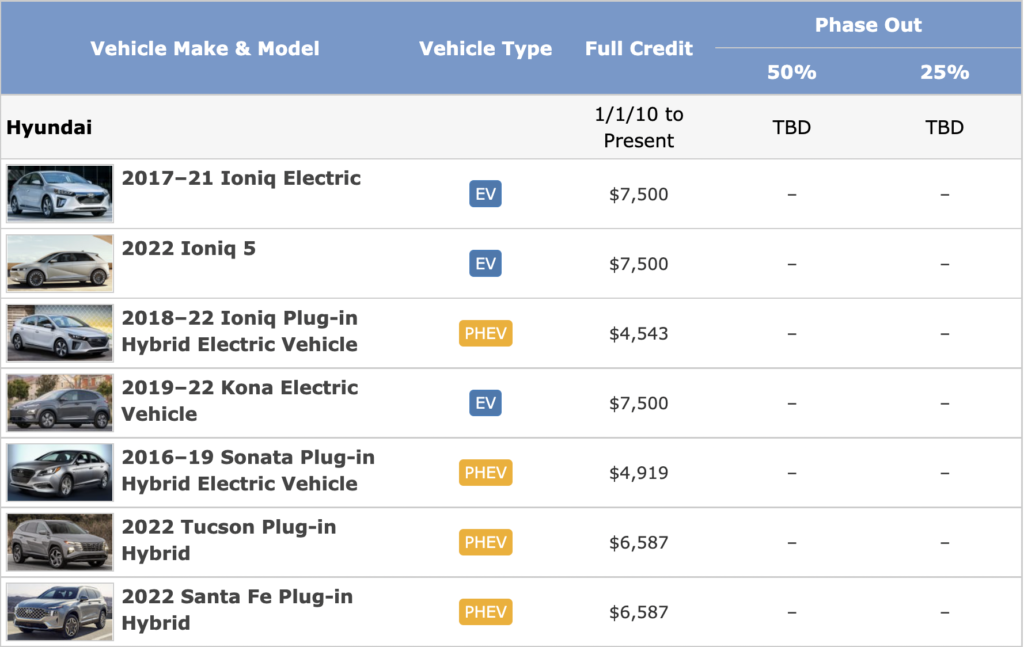

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

U S Senate Democratic Deal Would Expand Ev Tax Credits Reuters

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Ev Tax Credit Calculator Forbes Wheels

Anaheim Public Utilities Incentives

U S Ev Charging System A Priority Under Biden S 2 Trillion Infrastructure Plan

Tax Credit For Electric Vehicle Chargers Enel X Way

Automakers Ask Congress To Lift Electric Vehicle Tax Cap Abc News

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

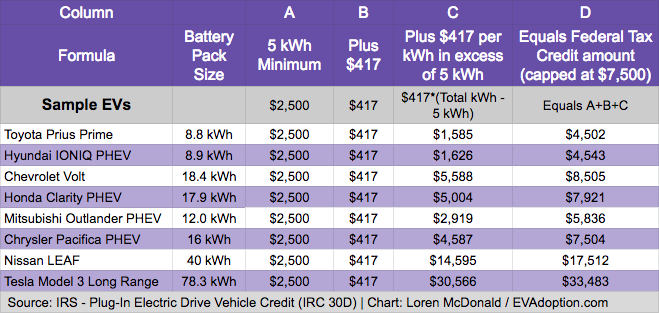

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Ev Tax Credit Calculator Forbes Wheels

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

How Do Electric Car Tax Credits Work Kelley Blue Book

Electric Vehicles Should You Buy This Year Investor S Business Daily